InvestorPlace

About The Author

LATEST ARTICLES

-

Apple’s Dividend Growth and Huge Buybacks Are a Big Win for Investors

Apple (NASDAQ:AAPL) has been very shareholder-friendly in the past 10 years. It started paying a dividend 10 years ago starting at the end of its fiscal year ending September 2012. In the past nine fiscal years, it has been paying and growing its dividend per share (DPS) as well as buying back shares. The bottom…

-

5 Industrial Stocks to Buy for October

U.S. industrial production is booming as demand for steel, consumer goods and energy-related products jumps. Indeed, one index of U.S. industrial production used by the Federal Reserve is near an all-time high. Meanwhile, I still expect Congress to eventually pass both an infrastructure bill and a huge budget that will include many positive catalysts for…

-

7 Financial Stocks to Buy to Get Ready for the Fed’s Next Move

Financial stocks could be on the verge of higher returns. Rising inflation levels over the summer months convinced investors that the Federal Reserve would soon pump the brakes on its monetary stimulus program. Now it seems an imminent interest rate hike is looming around the corner. Higher interest rates often lead to increasing profit margins…

-

A Bullish Take on China’s Crackdowns and Alibaba Stock

It’s been an absolutely brutal year for Alibaba (NYSE:BABA) stock investors. And I would know – I’m one of them. But anyone who has followed Alibaba already knows that BABA stock is down 42.3% since the beginning of December 2020. You’d never guess BABA stock would have such abysmal returns based on Alibaba’s underlying business,…

-

7 Stocks to Buy Now for an Oil Rally This Fall

Energy stocks are finally heating back up — after seven rough years for the sector, many stocks to buy are emerging again. The value of oil started to crash back in 2014, thanks to a price war among overseas producers. Natural gas had been in a steep downtrend as well. As a result, energy companies…

-

This Is the Worst Thing You Can Do in the Stock Market

There are a lot of bad things you can do in the stock market. Freaking out during a sell-off. Getting too greedy during a rally. Buying a penny stock without limit orders. Forgetting to set a stop-loss on a volatile stock. All bad things. But the single worst mistake you can make in markets is…

-

If Bitcoin Really Is Digital Gold, Then $500,000 Is the Next Stop

Everyone loves to throw out long-term price targets on Bitcoin. ARK Invest fund manager Cathie Wood last week reiterated her firm’s call for Bitcoin to trend toward $500,000 per coin over the next several years. Tyler Winklevoss of Facebook fame and big crypto enthusiast has also pounded on the table about a $500,000 long-term price…

-

7 Upcoming IPOs That Are Getting Everyone Very Excited

Despite the novel coronavirus pandemic, last year saw several highly anticipated initial public offerings, or IPOs. According to FactSet data, the volume of IPOs more than doubled from 2019, with 494 IPOs raising a combined $174 billion, setting new records on both counts. Last year saw the debut of Airbnb (NASDAQ:ABNB), Palantir (NYSE:PLTR), Snowflake (NYSE:SNOW),…

-

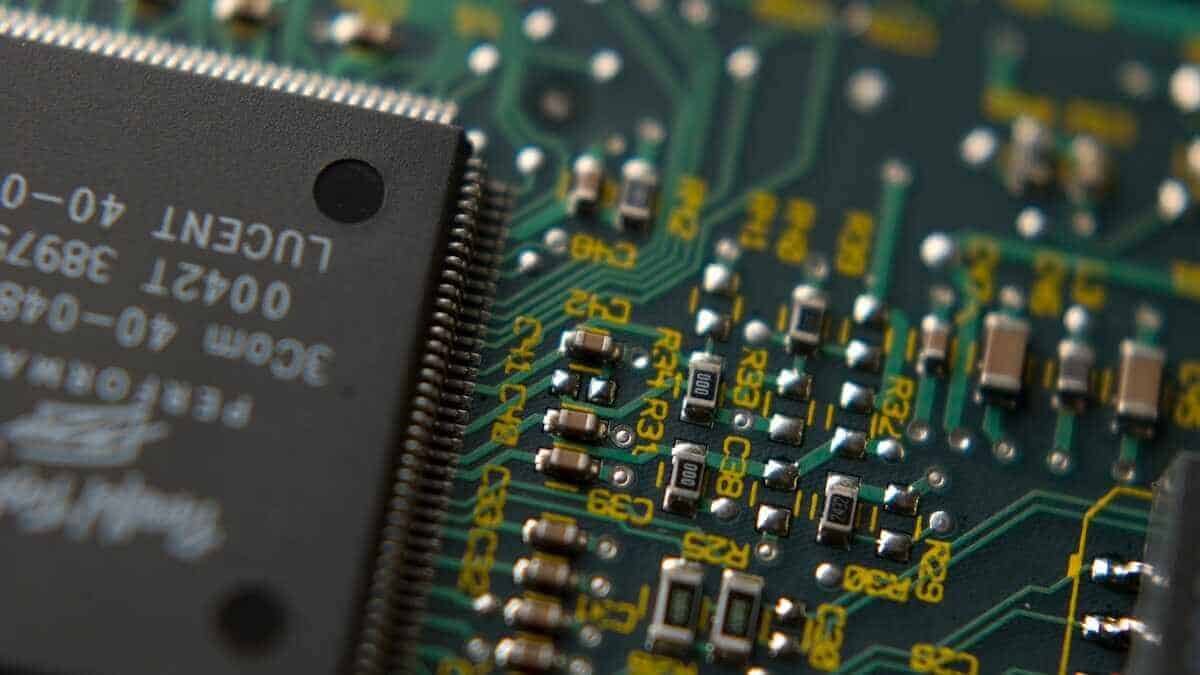

8 Semiconductor Stocks to Watch as Google Makes Its Own Chips

In recent months, we’ve seen major consumer tech firms announce that they were planning on using homemade chips rather than outsource their chip development. In a world of growing specialization when even big companies stick to their knitting within their strategic sectors, this seems to cut across the grain. With all the great chipmakers out…